Choosing the Right Invoicing Software: A Guide for Small Businesses

Introduction

Importance of Choosing the Right Invoicing Software: Invoicing software plays a crucial role in the financial health and operational efficiency of small businesses. It streamlines the process of creating and managing invoices, reduces errors, improves cash flow management, and enhances professionalism in client interactions.

Overview of How Invoicing Software Streamlines Business Operations: By automating invoicing processes, software reduces manual effort, speeds up payment cycles, and provides real-time insights into financial transactions. This improves overall business agility and decision-making.

Benefits of Using Invoicing Software

Efficiency Gains in Invoicing Processes: Invoicing software services automates repetitive tasks such as invoice creation, sending reminders for overdue payments, and tracking payment statuses. This frees up time for small business owners and staff to focus on core activities.

Reduction of Human Errors and Delays: Automated calculations and standardized templates minimize errors in invoices, ensuring accuracy in billing and reducing the risk of disputes with clients.

Improved Cash Flow Management: Timely invoicing and faster payment processing lead to improved cash flow visibility. Features like recurring billing and online payment options accelerate cash inflows, crucial for sustaining operations and growth.

Enhanced Customer Relationships Through Professional Invoices: Customizable invoice templates with company logos and personalized messages project a professional image. Clear, detailed invoices build trust and credibility with clients, fostering long-term relationships.

Key Considerations When Choosing Invoicing Software

1. Business Needs Assessment: Before selecting software, businesses must identify specific requirements such as invoicing volume, complexity (e.g., multi-currency support), integration needs with existing systems (like CRM or accounting software), and compliance requirements (e.g., tax regulations).

2. Ease of Use and Integration: User-friendly interfaces facilitate quick adoption across teams. Integration capabilities with other software (e.g., accounting systems, payment gateways) streamline workflows and reduce data entry redundancies.

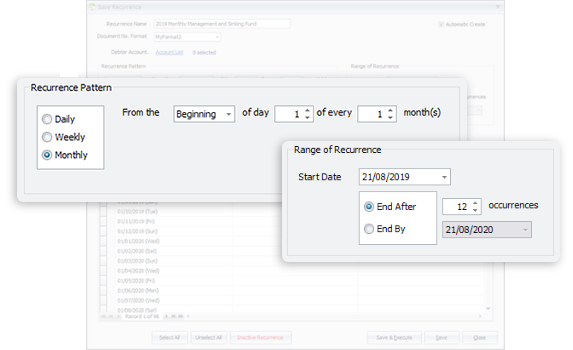

3. Features and Customization Options: Essential features like Accounts Receivable, Accounts Payable, and General Ledger are foundational. Advanced functionalities such as multi-location support, consignment management, and robust financial reporting cater to diverse business needs.

4. Security and Compliance: Robust security measures such as data encryption and secure servers safeguard sensitive financial information. Compliance with local tax regulations (e.g., GDPR in Europe, IRAS in Singapore) ensures legal adherence and protects against penalties.

5. Scalability: The software should accommodate business growth by supporting increased invoicing volumes, additional users, and expanded functionalities without significant disruptions or the need for frequent upgrades.

6. Customer Support and Training: Accessible customer support channels (e.g., phone, email, live chat) ensure prompt assistance for technical issues or inquiries. Comprehensive training resources (e.g., tutorials, webinars) facilitate smooth onboarding and proficiency among staff members.

Step-by-Step Guide to Choosing Invoicing Software

Define Your Requirements: Create a detailed list of must-have features (e.g., recurring invoices, late payment reminders) and nice-to-have features (e.g., mobile app access). Consider scalability to anticipate future business needs.

Research and Shortlist: Utilize online reviews, recommendations from peers or industry experts, and software demos to evaluate options. Look for software that aligns closely with identified requirements and budget constraints.

Compare Options: Assess software based on critical criteria such as functionality, cost (including subscription fees and setup costs), customer support quality, and user reviews. Request trials or demos to experience usability firsthand.

Make a Decision: Select software that best matches business needs, taking into account long-term benefits and return on investment. Evaluate pricing models (e.g., monthly subscriptions vs. one-time purchase) to find the most cost-effective solution.

Implementation and Training: Plan implementation carefully to minimize disruption to daily operations. Provide thorough training sessions to ensure all users are comfortable with the new software and its features.

Monitor and Evaluate: Regularly monitor software performance and gather feedback from users to identify areas for improvement. Stay updated with software updates and new features that could further enhance efficiency.

Conclusion

Summarize the Importance of Choosing the Right Invoicing Software: Emphasize how selecting the right invoicing software can streamline operations, improve financial management, and enhance customer relationships, ultimately contributing to business growth and sustainability.

Encourage Actionable Steps: Encourage small businesses to take proactive steps in selecting software that meets their specific needs and goals, highlighting the impact on operational efficiency and financial health.

Call-to-Action: Recommend reputable software solutions like AutoCount Accounting Software, emphasizing its features, integration capabilities, and positive user experiences as examples of effective invoicing solutions.

By following this detailed guide, small businesses can navigate the process of choosing invoicing software with confidence, ensuring it aligns with their operational requirements and contributes to long-term success.

Comments

Post a Comment